Small business groups have complained that they got short shrift from the economic stimulus bill. It seemed like small business was completely ignored. Now as the government finally starts to deal with unemployment, President Obama now seems to agree. The problem is that some of the rhetoric that is being discussed to help small business clashes with his policy goals like health care reform, cap and trade and the card check bills.

Forbes magazine recently had a good article articulating the issues.

Click the link below to read the full story:http://www.forbes.com/2009/12/08/barack-obama-credit-small-business-washington-obama.html?partner=alerts

Thursday, December 31, 2009

OBAMA'S SMALL BUSINESS CONUNDRUM

Wednesday, December 30, 2009

DO I HAVE TO PAY TAXES ON BACK CHILD SUPPORT?

I am a single mom. My ex-husband did not pay support for his daughter for more than 5 years. He just came into some money and has recently paid almost all of his back support to me. Now I’m worried because my mom says I have to pay taxes on that money. I was hoping to use it to pay bills but I don’t want to use it if I need to save some for taxes.

Thank you for taking the time to answer my question.

Mandy

Good for you Mandy, plus I have some good news for you. My mom used to say, “moms are always right,” but fortunately for you, that’s not the case here.

For federal purposes, child support is tax neutral, meaning that you don’t claim it as income and your ex-husband does not get to take a deduction for paying it.

Note that my answer would be different if this was back payment of alimony.

Larry Kopsa CPA

Thank you for taking the time to answer my question.

Mandy

Good for you Mandy, plus I have some good news for you. My mom used to say, “moms are always right,” but fortunately for you, that’s not the case here.

For federal purposes, child support is tax neutral, meaning that you don’t claim it as income and your ex-husband does not get to take a deduction for paying it.

Note that my answer would be different if this was back payment of alimony.

Larry Kopsa CPA

Tuesday, December 29, 2009

QUOTE OF THE WEEK

Christmas is the time when

kids tell Santa what they want

and adults pay for it.

Deficits are when adults tell

government what they want

and their kids pay for it.

~Richard Lamm

kids tell Santa what they want

and adults pay for it.

Deficits are when adults tell

government what they want

and their kids pay for it.

~Richard Lamm

HOW THE GOVERNMENT WORKS

Once upon a time the government had a vast scrap yard in the middle of a desert.

Congress said, "Someone may steal from it at night." So they created a night watchman position and hired a person for the job.

Then Congress said, "How does the watchman do his job without instruction?" So they created a planning department and hired two people, one person to write the instructions, and one person to do time studies.

Then Congress said, "How will we know the night watchman is doing the tasks correctly?" So they created a Quality Control department and hired two people. One to do the studies and one to write the reports.

Then Congress said, "How are these people going to get paid?" So They created the following positions, a time keeper, and a payroll officer, Then hired two people.

Then Congress said, "Who will be accountable for all of these people?" So they created an administrative section and hired three people, an Administrative Officer, Assistant Administrative Officer, and a Legal Secretary.

Then Congress said, "We have had this command in operation for one Year and we are $18,000 over budget, we must cutback overall cost."

So they laid off the night watchman.

NOW slowly, let it sink in..

Does anybody remember the reason given for the establishment of the DEPARTMENT OF ENERGY.... during the Carter Administration?

Anybody?

Anything?

No?

Bottom line. We've spent several hundred billion dollars in support of an agency...the reason for which not one person who reads this can remember!

Ready??

It was very simple...and at the time, everybody thought it very appropriate.

The Department of Energy was instituted on 8-04-1977. To lessen our dependence on foreign oil.

Hey, pretty efficient, huh???

And now it's 2009 -- 32 years later -- and the budget for this "necessary" department is at $24.2 billion a year. They have 16,000 federal employees and approximately 100,000 contract employees; and look at the job they have done! This is where you slap our forehead and say, "what was I thinking?"

Ah, yes -- good ole bureaucracy.

And, now, we are going to turn the banking system, health care, and the auto industry over to the same government?

HELLOOO! Anybody Home?

Congress said, "Someone may steal from it at night." So they created a night watchman position and hired a person for the job.

Then Congress said, "How does the watchman do his job without instruction?" So they created a planning department and hired two people, one person to write the instructions, and one person to do time studies.

Then Congress said, "How will we know the night watchman is doing the tasks correctly?" So they created a Quality Control department and hired two people. One to do the studies and one to write the reports.

Then Congress said, "How are these people going to get paid?" So They created the following positions, a time keeper, and a payroll officer, Then hired two people.

Then Congress said, "Who will be accountable for all of these people?" So they created an administrative section and hired three people, an Administrative Officer, Assistant Administrative Officer, and a Legal Secretary.

Then Congress said, "We have had this command in operation for one Year and we are $18,000 over budget, we must cutback overall cost."

So they laid off the night watchman.

NOW slowly, let it sink in..

Does anybody remember the reason given for the establishment of the DEPARTMENT OF ENERGY.... during the Carter Administration?

Anybody?

Anything?

No?

Bottom line. We've spent several hundred billion dollars in support of an agency...the reason for which not one person who reads this can remember!

Ready??

It was very simple...and at the time, everybody thought it very appropriate.

The Department of Energy was instituted on 8-04-1977. To lessen our dependence on foreign oil.

Hey, pretty efficient, huh???

And now it's 2009 -- 32 years later -- and the budget for this "necessary" department is at $24.2 billion a year. They have 16,000 federal employees and approximately 100,000 contract employees; and look at the job they have done! This is where you slap our forehead and say, "what was I thinking?"

Ah, yes -- good ole bureaucracy.

And, now, we are going to turn the banking system, health care, and the auto industry over to the same government?

HELLOOO! Anybody Home?

Monday, December 28, 2009

MORE ON CHARITABLE CONTRIBUTIONS

Thanks for the information on charitable contributions. My mother has been making some contributions to some weird supposedly child care organization.

How do I find out if this is a legitimate charity?

Opy

Opy, it is good to double check if you are not sure. Not only on the “weird” groups but also on groups that you think would qualify. I recently had a client give money to a local Children’s Workshop only to find that they had not done the paperwork to make them a legitimate tax exempt charity. Not checking cost them the deduction.

Here is how you can check to see if the organization is qualified. As you know, only donations to qualified organizations are tax-deductible. IRS Publication 78, available online and at many public libraries, lists most organizations that are qualified to receive deductible contributions. The searchable online version can be found at IRS.gov under Search for Charities. In addition, churches, synagogues, temples, mosques and government agencies are eligible to receive deductible donations, even if they are not listed in Publication 78.

Larry Kopsa CPA

How do I find out if this is a legitimate charity?

Opy

Opy, it is good to double check if you are not sure. Not only on the “weird” groups but also on groups that you think would qualify. I recently had a client give money to a local Children’s Workshop only to find that they had not done the paperwork to make them a legitimate tax exempt charity. Not checking cost them the deduction.

Here is how you can check to see if the organization is qualified. As you know, only donations to qualified organizations are tax-deductible. IRS Publication 78, available online and at many public libraries, lists most organizations that are qualified to receive deductible contributions. The searchable online version can be found at IRS.gov under Search for Charities. In addition, churches, synagogues, temples, mosques and government agencies are eligible to receive deductible donations, even if they are not listed in Publication 78.

Larry Kopsa CPA

PHONE BOOKS

Readers Digest says, "A few simple steps will keep those tree-toppling phone books from being delivered to your door. Go to yellowpagesoptout.com and plug in your zip code, suggests Rob Pegoraro of the Washington Post. You'll get a short list of companies to call to make the door stoppers stop."

Saturday, December 26, 2009

GUIDELINES FOR MONETARY DONATIONS

Now is the time when many people make year-end donations. Here is a reminder of the guidelines.

To deduct any charitable donation of money, regardless of amount, a taxpayer must have a bank record or a written communication from the charity showing the name of the charity and the date and amount of the contribution. Bank records include canceled checks, bank or credit union statements, and credit card statements.

Unfortunately, the cash you donate is no longer deductible because you would need a written confirmation. The Santa Clause ringing the bell at the Salvation Army bucket always looks at me funny when I ask for a receipt. To get a deduction I must write a check and drop it in the bucket.

These requirements for the deduction of monetary donations do not change the long-standing requirement that a taxpayer obtain an acknowledgment from a charity for each deductible donation (either money or property) of $250 or more. However, one statement containing all of the required information may meet both requirements.

Remember that contributions are deductible in the year made. Thus, donations charged to a credit card before the end of 2009 count for 2009. This is true even if the credit card bill isn’t paid until 2010. Also, checks count for 2009 as long as they are mailed in 2009 and clear shortly thereafter.

Larry Kopsa CPA

To deduct any charitable donation of money, regardless of amount, a taxpayer must have a bank record or a written communication from the charity showing the name of the charity and the date and amount of the contribution. Bank records include canceled checks, bank or credit union statements, and credit card statements.

Unfortunately, the cash you donate is no longer deductible because you would need a written confirmation. The Santa Clause ringing the bell at the Salvation Army bucket always looks at me funny when I ask for a receipt. To get a deduction I must write a check and drop it in the bucket.

These requirements for the deduction of monetary donations do not change the long-standing requirement that a taxpayer obtain an acknowledgment from a charity for each deductible donation (either money or property) of $250 or more. However, one statement containing all of the required information may meet both requirements.

Remember that contributions are deductible in the year made. Thus, donations charged to a credit card before the end of 2009 count for 2009. This is true even if the credit card bill isn’t paid until 2010. Also, checks count for 2009 as long as they are mailed in 2009 and clear shortly thereafter.

Larry Kopsa CPA

Thursday, December 24, 2009

QUESTION ON DEDUCTING USED CLOTHING

I am cleaning closets and will be giving a lot of clothing to the Salvation Army. Can I deduct this off of my taxes?

Amid

Amid, good idea if you are itemizing your deductions, which is sometimes called the “long form.” If you do itemize then the fair market value of the clothing will be deductible. This would also include household items such as old furniture.

To be deductible, clothing and household items donated to charity generally must be in good used condition or better. If it is not in “good” condition you would need an appraisal if the value is over $500. I don’t know how to get an appraisal of old clothing, but those are the rules. You would also need an appraisal if the fair market value is over $10,000.

Larry Kopsa CPA

Amid

Amid, good idea if you are itemizing your deductions, which is sometimes called the “long form.” If you do itemize then the fair market value of the clothing will be deductible. This would also include household items such as old furniture.

To be deductible, clothing and household items donated to charity generally must be in good used condition or better. If it is not in “good” condition you would need an appraisal if the value is over $500. I don’t know how to get an appraisal of old clothing, but those are the rules. You would also need an appraisal if the fair market value is over $10,000.

Larry Kopsa CPA

SOME YEAR-END REMINDERS

There are several deadlines for retirement plans, IRAs and Coverdells.

Generally, employer plans must be established by Dec. 31 to get a 2009 deduction. This includes Keoghs. But note the difference for SEPs; you have until the due date for filing your return, plus any extension. That lets you deduct 2009 payments as late as Oct. 15, 2010. There is another alternative for self employed taxpayers that missed the Keogh setup deadline. They still have time to open SEP-IRAs.

The plans have the same deduction amounts, 20% of net self-employment earnings. This is the net profit shown on your Schedule C less one-half of your SECA tax liability.

Regular IRAs must be established by April 15, 2010 for 2009 deductions. Payments are also due by April 15th even if you should extend your return.

Nondeductible payments to IRAs and Roth IRAs are also due by April 15. The same is true for contributions made to Coverdell education savings accounts.

Another reminder… if you have a flexible spending account you must clean it out by December 31st if your employer has not adopted the 2½-month grace period that the IRS now permits. If you don’t spend the money - it is lost.

Also remember to mail checks for deductible items before year-end to ensure a 2009 write-off. You get to claim the deduction this year even if the checks do not clear until January. Make sure you know the rules if you are charging deductible items. For charges that you make with a retail store credit card, you are allowed to claim the deduction for the item only in the tax year in which you pay the bill. For transactions made with a bank credit card, you take the deduction in the tax year that you charged the goods, even though you pay the bill next year.

Generally, employer plans must be established by Dec. 31 to get a 2009 deduction. This includes Keoghs. But note the difference for SEPs; you have until the due date for filing your return, plus any extension. That lets you deduct 2009 payments as late as Oct. 15, 2010. There is another alternative for self employed taxpayers that missed the Keogh setup deadline. They still have time to open SEP-IRAs.

The plans have the same deduction amounts, 20% of net self-employment earnings. This is the net profit shown on your Schedule C less one-half of your SECA tax liability.

Regular IRAs must be established by April 15, 2010 for 2009 deductions. Payments are also due by April 15th even if you should extend your return.

Nondeductible payments to IRAs and Roth IRAs are also due by April 15. The same is true for contributions made to Coverdell education savings accounts.

Another reminder… if you have a flexible spending account you must clean it out by December 31st if your employer has not adopted the 2½-month grace period that the IRS now permits. If you don’t spend the money - it is lost.

Also remember to mail checks for deductible items before year-end to ensure a 2009 write-off. You get to claim the deduction this year even if the checks do not clear until January. Make sure you know the rules if you are charging deductible items. For charges that you make with a retail store credit card, you are allowed to claim the deduction for the item only in the tax year in which you pay the bill. For transactions made with a bank credit card, you take the deduction in the tax year that you charged the goods, even though you pay the bill next year.

Tuesday, December 22, 2009

QUOTE OF THE WEEK

"Speaking of the budget, in his speech on the economy, President Obama said that we have to 'continue to spend our way out' of the recession. Now, I don't know much about economics, but aren't we like a trillion dollars in debt? Spending our way out of the recession? Isn't that like trying to drink your way out of alcoholism? I'm just saying." ~Jay Leno Monologue

WALL STREET JOURNAL OPINION

'Health Care Bill Represents Change Nobody Believes In'

(Wall Street Journal editorial) -- In its Dec. 21 editorial, The Wall Street Journal writes that the Senate health care bill "is so reckless that it has to be rammed through on a partisan vote on Christmas Eve." The editorial states, "Barring some extraordinary reversal, it now seems as if (Senate leaders) have the 60 votes they need" to approve "the 2,100-page bill." The editorial notes a cost analysis that was recently released by the insurer WellPoint, finding "that a healthy 25-year-old in Milwaukee buying coverage on the individual market will see his costs rise by 178%. A small business based in Richmond with eight employees in average health will see a 23% increase. Insurance costs for a 40-year-old family with two kids living in Indianapolis will pay 106% more." The editorial predicts "steep declines in choice and quality," resulting from actions such as the health care bill's "$2 billion annual tax — rising to $3 billion in 2018 — that will be leveled against medical device makers, among the most innovative U.S. industries." Finally, the bill will "blow up" the federal deficit, the editorial states. "Even though Medicare's unfunded liabilities are already about 2.6 times larger than the entire U.S. economy in 2008, Democrats are crowing that ObamaCare will cost 'only' $871 billion over the next decade" as it "sets up government-run 'exchanges' that will subsidize insurance for those earning up to 400% of the poverty level, or $96,000 for a family of four in 2016." <http://online.wsj.com/article/SB10001424052748704398304574598130440164954.html?mod=WSJ_hpp_MIDDLENexttoWhatsNewsTop>

(Wall Street Journal editorial) -- In its Dec. 21 editorial, The Wall Street Journal writes that the Senate health care bill "is so reckless that it has to be rammed through on a partisan vote on Christmas Eve." The editorial states, "Barring some extraordinary reversal, it now seems as if (Senate leaders) have the 60 votes they need" to approve "the 2,100-page bill." The editorial notes a cost analysis that was recently released by the insurer WellPoint, finding "that a healthy 25-year-old in Milwaukee buying coverage on the individual market will see his costs rise by 178%. A small business based in Richmond with eight employees in average health will see a 23% increase. Insurance costs for a 40-year-old family with two kids living in Indianapolis will pay 106% more." The editorial predicts "steep declines in choice and quality," resulting from actions such as the health care bill's "$2 billion annual tax — rising to $3 billion in 2018 — that will be leveled against medical device makers, among the most innovative U.S. industries." Finally, the bill will "blow up" the federal deficit, the editorial states. "Even though Medicare's unfunded liabilities are already about 2.6 times larger than the entire U.S. economy in 2008, Democrats are crowing that ObamaCare will cost 'only' $871 billion over the next decade" as it "sets up government-run 'exchanges' that will subsidize insurance for those earning up to 400% of the poverty level, or $96,000 for a family of four in 2016." <http://online.wsj.com/article/SB10001424052748704398304574598130440164954.html?mod=WSJ_hpp_MIDDLENexttoWhatsNewsTop>

Monday, December 21, 2009

OPINION: 'WHEN IT COMES TO CLIMATE CHANGE, FOLLOW THE MONEY'

(Wall Street Journal) -- Wall Street Journal columnist Bret Stephens writes that citizens should employ "follow-the-money methods" when it comes to concerns regarding leading climate scientists who have worked "in tandem to block freedom of information requests" and "obscure, destroy or massage inconvenient temperature data—facts." Stephens writes: "Consider the case of Phil Jones ... the man at the heart of climategate. (B)etween 2000 and 2006, Mr. Jones was the recipient (or co-recipient) of some $19 million worth of research grants, a six fold increase over what he'd been awarded in the 1990s." More than $94 billion in government money has been spent globally this year on "green stimulus," according to one estimate. See more at <http://online.wsj.com/article/SB10001424052748703939404574566124250205490.html?mod=WSJ_hp_mostpop_read>

Thursday, December 17, 2009

TAX BREAK FOR TIRADE?

Serena Williams, verbally attacked a line judge during the U.S. Open Championship and was hit with at $175,000 fine. The question is, “Can she deduct the fine?” Here is a interesting analysis. (Maybe this is just interesting to us tax people.)

Serena Williams, verbally attacked a line judge during the U.S. Open Championship and was hit with at $175,000 fine. The question is, “Can she deduct the fine?” Here is a interesting analysis. (Maybe this is just interesting to us tax people.)Can Williams get a tax break for her tirade?

STATUS OF ESTATE TAXES

Around ten years ago, congress passed a law stating that in the year 2010 there would be no estate taxes. Nobody in the tax industry felt that this would really happen. Imagine this, Warren Buffett, whose worth billions of dollars in 2010, dies and he completely escapes estate taxes. The joke in the industry was to “advise your clients to die in 2010.” That’s the kind of humor that we tax people have.

Well, everybody thought the law would change and then five years passed; and now we are here three weeks before the end of the year and congress is now starting to say, “We’re going to lose a lot of money if there are no estate taxes in 2010; maybe we should change the law.”

Now they are discussing the possibility of making sure that there is an estate tax in 2010. Best guess is that they’ll pass a law sometime before the end of the year. Maybe they’ll leave the estate tax rate at three and one half million dollars. Who knows?

Oh, that’s not all, if congress does nothing the estate tax rate will revert back to $1,000,000 in 2011 with a high rate of 55%.

We’ll keep you posted as congress deals with this issue at the last minute.

The Washington Post has more information on the Estate Tax. Click here to read: Extending The Estate Tax.

Well, everybody thought the law would change and then five years passed; and now we are here three weeks before the end of the year and congress is now starting to say, “We’re going to lose a lot of money if there are no estate taxes in 2010; maybe we should change the law.”

Now they are discussing the possibility of making sure that there is an estate tax in 2010. Best guess is that they’ll pass a law sometime before the end of the year. Maybe they’ll leave the estate tax rate at three and one half million dollars. Who knows?

Oh, that’s not all, if congress does nothing the estate tax rate will revert back to $1,000,000 in 2011 with a high rate of 55%.

We’ll keep you posted as congress deals with this issue at the last minute.

The Washington Post has more information on the Estate Tax. Click here to read: Extending The Estate Tax.

Wednesday, December 16, 2009

QUOTE OF THE WEEK

"Old age is like climbing a mountain.

The higher you get, the more tired and

breathless you become, but your view

becomes much more extensive."

Ingmar Bergman,

quoted in the Victoria, British Columbia, Advocate

The higher you get, the more tired and

breathless you become, but your view

becomes much more extensive."

Ingmar Bergman,

quoted in the Victoria, British Columbia, Advocate

Tuesday, December 15, 2009

ADDING BACK TO YOUR W-2

As you know, it is necessary to add back to your W-2 the personal use of your corporate vehicle as well as the amount of Health Insurance the corporation paid on behalf of a greater than 2% shareholder and their families.

Here is a link to the letter we sent out to all of our clients regarding this issue: W-2 Add Back.

Here is a link to the letter we sent out to all of our clients regarding this issue: W-2 Add Back.

JUST THINKING...

What hair color do they put on the driver's licenses of bald men?

Monday, December 14, 2009

NEW RULES FOR DISCLOSING TAX RETURN INFORMATION TO THIRD PARTIES

Federal law already strictly prohibited the IRS from making disclosures of taxpayer return information within its control to third parties except with taxpayer consent. Now there are new rules that apply only to tax return information held by income tax return preparers.

So, if you would like your income tax preparer to send copies of your tax return to a third party, i.e.-your bank, your attorney..., a specific form will need to be completed, signed and returned to your tax preparer's office. This form will be held on file for one year unless specified otherwise.

You may access the Kopsa Otte consent form on our website at www.kopsaotte.com. Here's a direct link to our Third Party Consent Form for your convenience.

Below is an explanation of the rules. Please be sure to contact us if you have any questions. (800-975-4829)

Among the new rules:

So, if you would like your income tax preparer to send copies of your tax return to a third party, i.e.-your bank, your attorney..., a specific form will need to be completed, signed and returned to your tax preparer's office. This form will be held on file for one year unless specified otherwise.

You may access the Kopsa Otte consent form on our website at www.kopsaotte.com. Here's a direct link to our Third Party Consent Form for your convenience.

Below is an explanation of the rules. Please be sure to contact us if you have any questions. (800-975-4829)

Among the new rules:

- Generally, preparers must obtain taxpayer consent, either by paper or electronically depending on how the return is being filed, before tax return information can be disclosed to any third party or used for any purpose other than filing the return.

- If the taxpayer consents to the disclosure and use of his information, the consent must identify the intended purpose of the disclosure, identify the recipients and describe the particular authorized disclosure or use of the information.

- Mandatory language informs individual taxpayers that they are not required to sign the consent; that if they sign the consent, federal law may not protect their information from further disclosure; and that if they sign the consent, they can set a time period for the duration of that consent. If taxpayers fail to set a time period, the consent is valid for a maximum of one year.

- To prevent consent requests from individual taxpayers from being buried in fine print, the rules require the paper consent documents to be in 12-point type on 81/2 by 11 inch paper and require electronic consent requests to be in the same type as the Web site’s standard text, all to prevent consent requests from being too difficult to read for individual taxpayers.

- If a taxpayer declines to provide consent for an unrelated tax preparation disclosure or use request, the preparer cannot make a similar consent request. The intent is to protect taxpayers from being pressured with repeated consent requests regarding the same issue.

- Mandatory consent from taxpayers also is required if the tax information is going to be disclosed to a tax preparer located outside the United States. This provision is intended to ensure taxpayers are informed if their tax information is being sent off-shore for return preparation. The individual taxpayer’s Social Security Number also must be redacted.

Friday, December 11, 2009

FORM 1099 AND W-2 LETTER

Here is a letter that we sent reminding our clients to issue the proper forms to all Independent Contractors. If you need more information regarding this issue, please feel free to contact us.

Re: Forms 1099 and W-2

It is that time of year again to issue 1099 forms. In order to determine this, it is necessary for employers to have a signed W-9 form on file for all Independent Contractors they hire. The IRS requires that you send a Form 1099 to all individuals (not corporations) to whom you paid $600.00 or more for services, interest or rent. There is one exception to this. Any payments to a corporation for legal fees in excess of $600.00 are reportable on Form 1099-MISC. This is very important since the IRS will match 1099’s to the individual income tax returns in order to determine whether or not all income was properly reported.

Our past experience is that, if your income tax return is audited, one of the first items reviewed is whether you submitted all of the necessary Form 1099’s. This is an easy way for the IRS to raise revenues (by charging you a penalty) and force you to comply with the law.

The penalty for not complying with the filing of Form 1099’s ranges from $15.00 to $100.00 for each form not properly completed and timely filed. If the IRS can determine that a Form 1099 was intentionally not filed, the penalty is $100.00.

Nebraska is requiring all employers to report newly hired and rehired employees to the state within 20 days of date of hire. Effective January 1, 2010 employers will be required to report all Independent Contractors in addition to the new hires and rehired employees.

Another important issue is the filing of the W-2 forms. These forms must be given to your employees by February 1, 2010.

If you would like our firm to compile the necessary information and/or prepare the necessary Form 1099’s and W-2’s for you, please sign and return the enclosed engagement letter along with the completed, appropriate 1099 and W-2 worksheets to our office. Since the first returns are due February 1, 2010 we are offering a discount if you provide us with the information on or before January 11, 2010. Of course, there is no fee for the 1099 we prepare for us. That 1099 is free. If you wish to fax your information to us, our fax number is (402) 362-5475.

If you have any questions, please contact Jane Rosenau or Cheryl Harlow at our office at (402) 362-6636 or (800) 975-4829.

Kopsa Otte

Certified Public Accountants

Re: Forms 1099 and W-2

It is that time of year again to issue 1099 forms. In order to determine this, it is necessary for employers to have a signed W-9 form on file for all Independent Contractors they hire. The IRS requires that you send a Form 1099 to all individuals (not corporations) to whom you paid $600.00 or more for services, interest or rent. There is one exception to this. Any payments to a corporation for legal fees in excess of $600.00 are reportable on Form 1099-MISC. This is very important since the IRS will match 1099’s to the individual income tax returns in order to determine whether or not all income was properly reported.

Our past experience is that, if your income tax return is audited, one of the first items reviewed is whether you submitted all of the necessary Form 1099’s. This is an easy way for the IRS to raise revenues (by charging you a penalty) and force you to comply with the law.

The penalty for not complying with the filing of Form 1099’s ranges from $15.00 to $100.00 for each form not properly completed and timely filed. If the IRS can determine that a Form 1099 was intentionally not filed, the penalty is $100.00.

Nebraska is requiring all employers to report newly hired and rehired employees to the state within 20 days of date of hire. Effective January 1, 2010 employers will be required to report all Independent Contractors in addition to the new hires and rehired employees.

Another important issue is the filing of the W-2 forms. These forms must be given to your employees by February 1, 2010.

If you would like our firm to compile the necessary information and/or prepare the necessary Form 1099’s and W-2’s for you, please sign and return the enclosed engagement letter along with the completed, appropriate 1099 and W-2 worksheets to our office. Since the first returns are due February 1, 2010 we are offering a discount if you provide us with the information on or before January 11, 2010. Of course, there is no fee for the 1099 we prepare for us. That 1099 is free. If you wish to fax your information to us, our fax number is (402) 362-5475.

If you have any questions, please contact Jane Rosenau or Cheryl Harlow at our office at (402) 362-6636 or (800) 975-4829.

Kopsa Otte

Certified Public Accountants

Wednesday, December 9, 2009

KOPSA OTTE STRIVING FOR CONSTANT IMPROVEMENT

We are proud to announce that Theresa Fritz has earned the distinguished designation of Enrolled Agent.

We are proud to announce that Theresa Fritz has earned the distinguished designation of Enrolled Agent.Theresa, an accountant with Kopsa Otte since November of 2006, recently passed this three-part test administered by the IRS to earn her EA.

As an Enrolled Agent, Theresa has technical expertise in the field of taxation and is empowered to represent taxpayers before all administrative levels of the IRS for audits, collections, and appeals.

Congratulations Theresa! We're proud of your accomplishment!

Tuesday, December 8, 2009

MORE ECONOMIC NEWS

Spending will be hurt by another dip in consumer debt

Consumer spending is expected to remain weak after the release Monday of a Federal Reserve report that showed consumer borrowing falling for a ninth straight month in October. Consumer credit was down at an annual rate of $3.5 billion in October. Economists had predicted a $9.3 billion decline. BusinessWeek/The Associated Press (12/7)

Next crisis to be in commercial real estate, experts say

A crisis looms for the commercial real estate market in 2010, then for the government-debt market, particularly in the U.S., investment managers said. "I think the next shoe to drop, which will be the world's biggest shoe, is the continued decline of the dollar and ultimately the breaking of the U.S. government market, which will set the other markets on another terrible path," said Steve Shenfeld, president of MidOcean Credit Partners. The danger of default on commercial real estate also is a major threat, Shenfeld said. Reuters (12/7)

Consumer spending is expected to remain weak after the release Monday of a Federal Reserve report that showed consumer borrowing falling for a ninth straight month in October. Consumer credit was down at an annual rate of $3.5 billion in October. Economists had predicted a $9.3 billion decline. BusinessWeek/The Associated Press (12/7)

Next crisis to be in commercial real estate, experts say

A crisis looms for the commercial real estate market in 2010, then for the government-debt market, particularly in the U.S., investment managers said. "I think the next shoe to drop, which will be the world's biggest shoe, is the continued decline of the dollar and ultimately the breaking of the U.S. government market, which will set the other markets on another terrible path," said Steve Shenfeld, president of MidOcean Credit Partners. The danger of default on commercial real estate also is a major threat, Shenfeld said. Reuters (12/7)

INFORMATION ON THE EXTENDED 1ST TIME HOMEBUYERS CREDIT

I just got the information below from the IRS. I have discussed this before, but thought you might be interested. Note that the IRS is going Hi Tec… there is a U Tube link below.

10 Important Facts about the Extended First-Time Homebuyer Credit

If you are in the market for a new home, you may still be able to claim the First-Time Homebuyer Credit. Congress recently passed The Worker, Homeownership and Business Assistance Act Of 2009, extending the First-Time Homebuyer Credit and expanding who qualifies.

Here are the top 10 things the IRS wants you to know about the expanded credit and the qualifications you must meet in order to qualify for it.

1. You must buy – or enter into a binding contract to buy a principal residence – on or before April 30, 2010.

2. If you enter into a binding contract by April 30, 2010 you must close on the home on or before June 30, 2010.

3. For qualifying purchases in 2010, you will have the option of claiming the credit on either your 2009 or 2010 return.

4. A long-time resident of the same home can now qualify for a reduced credit. You can qualify for the credit if you’ve lived in the same principal residence for any five-consecutive year period during the eight-year period that ended on the date the new home is purchased and the settlement date is after November 6, 2009.

5. The maximum credit for long-time residents is $6,500. However, married individuals filing separately are limited to $3,250.

6. People with higher incomes can now qualify for the credit. The new law raises the income limits for homes purchased after November 6, 2009. The full credit is available to taxpayers with modified adjusted gross incomes up to $125,000, or $225,000 for joint filers.

7. The IRS will issue a December 2009 revision of Form 5405 to claim this credit. The December 2009 form must be used for homes purchased after November 6, 2009 – whether the credit is claimed for 2008 or for 2009 – and for all home purchases that are claimed on 2009 returns.

8. No credit is available if the purchase price of the home exceeds $800,000.

9. The purchaser must be at least 18 years old on the date of purchase. For a married couple, only one spouse must meet this age requirement.

10. A dependent is not eligible to claim the credit.

For more information about the expanded First-Time Home Buyer Credit, visit IRS.gov/recovery.

Links:

· First-Time Homebuyer Credit

· IR-2009-108, First-Time Homebuyer Credit Extended to April 30, 2010; Some Current Homeowners Now Also Qualify

YouTube Videos:

· Recovery: New Homebuyer Credit - November 2009

10 Important Facts about the Extended First-Time Homebuyer Credit

If you are in the market for a new home, you may still be able to claim the First-Time Homebuyer Credit. Congress recently passed The Worker, Homeownership and Business Assistance Act Of 2009, extending the First-Time Homebuyer Credit and expanding who qualifies.

Here are the top 10 things the IRS wants you to know about the expanded credit and the qualifications you must meet in order to qualify for it.

1. You must buy – or enter into a binding contract to buy a principal residence – on or before April 30, 2010.

2. If you enter into a binding contract by April 30, 2010 you must close on the home on or before June 30, 2010.

3. For qualifying purchases in 2010, you will have the option of claiming the credit on either your 2009 or 2010 return.

4. A long-time resident of the same home can now qualify for a reduced credit. You can qualify for the credit if you’ve lived in the same principal residence for any five-consecutive year period during the eight-year period that ended on the date the new home is purchased and the settlement date is after November 6, 2009.

5. The maximum credit for long-time residents is $6,500. However, married individuals filing separately are limited to $3,250.

6. People with higher incomes can now qualify for the credit. The new law raises the income limits for homes purchased after November 6, 2009. The full credit is available to taxpayers with modified adjusted gross incomes up to $125,000, or $225,000 for joint filers.

7. The IRS will issue a December 2009 revision of Form 5405 to claim this credit. The December 2009 form must be used for homes purchased after November 6, 2009 – whether the credit is claimed for 2008 or for 2009 – and for all home purchases that are claimed on 2009 returns.

8. No credit is available if the purchase price of the home exceeds $800,000.

9. The purchaser must be at least 18 years old on the date of purchase. For a married couple, only one spouse must meet this age requirement.

10. A dependent is not eligible to claim the credit.

For more information about the expanded First-Time Home Buyer Credit, visit IRS.gov/recovery.

Links:

· First-Time Homebuyer Credit

· IR-2009-108, First-Time Homebuyer Credit Extended to April 30, 2010; Some Current Homeowners Now Also Qualify

YouTube Videos:

· Recovery: New Homebuyer Credit - November 2009

UPCOMING NUPTIALS

We are pleased to announce that one of our very own talented accountants will be changing her status to "Married - Filing Jointly."

We are pleased to announce that one of our very own talented accountants will be changing her status to "Married - Filing Jointly." Megan Munsell, will be united in marriage this Saturday the 12th to Mark Blinde, a Network Technician at Cornerstone Bank Technology Center.

Megan, who graduated as valedictorian of her college class, has been an accountant with Kopsa Otte since January of 2008; and she is a true asset to our Team. Remember, Megan's email address will change after this weekend to: mblinde@kopsaotte.com.

Our best wishes go out to Mark and Megan for a lifetime of happiness!

AMERICAN EXPRESS SAYS PAY YOUR CREDIT CARD BILL ON TIME OR YOU WILL LOSE YOUR POINTS

In case you haven’t heard, starting in January, American Express says that any credit cards that are cobranded with Delta JetBlue, Hilton or Starwoods won't receive reward points if you are late paying your bills. In other words, pay your bill on time or forfeit the miles or points you thought you earned for making purchases on your card during that month. To get the rewards back, it's going to cost you. You'll be hit with a $29 reinstatement fee if you want the rewards back. That fee is on top of the late-payment fee — $19 or $38 depending on your balance. A penalty interest rate, currently 27 percent, would be assessed on future balances.

Monday, December 7, 2009

CLOSING THE DEFICIT

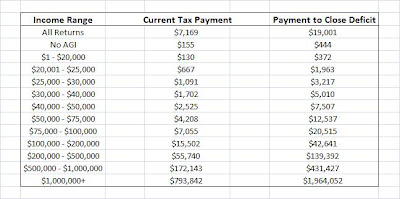

A couple weeks ago I posted the Tax Foundation's estimation of where tax rates will have to go to close the deficit. The foundation also calculated the average federal income tax payments that would be necessary to close the deficit. This exercise is even scarier. Right now the federal government takes in roughly $19,000 per household and spends $33,000. How much more would different taxpayers earning different incomes have to pay to close that gap?

Larry Kopsa CPA

DUBAI REJECTS ASSUMPTION IT IS RESPONSIBLE FOR DUBAI WORLD DEBT

Imagine this, a government rich with cash saying that creditors should be responsible for their actions and don’t depend on the government to bail them out. Maybe the guys in Washington should take note.

As creditors assumed that Dubai, United Arab Emirates, would guarantee the debt of Dubai World, the emirate rejected the idea. "Creditors need to take part of the responsibility for their decision to lend to the companies," said Abdulrahman al-Saleh, director general of the Department of Finance in Dubai. "They think Dubai World is part of the government, which is not correct." Dubai World said it is looking at a $26 billion debt restructuring, which would affect its property firms the most. Reuters (11/30) , The Wall Street Journal (11/30)

As creditors assumed that Dubai, United Arab Emirates, would guarantee the debt of Dubai World, the emirate rejected the idea. "Creditors need to take part of the responsibility for their decision to lend to the companies," said Abdulrahman al-Saleh, director general of the Department of Finance in Dubai. "They think Dubai World is part of the government, which is not correct." Dubai World said it is looking at a $26 billion debt restructuring, which would affect its property firms the most. Reuters (11/30) , The Wall Street Journal (11/30)

Friday, December 4, 2009

'HACKED E-MAILS FUEL CLIMATE CHANGE DEBATE'

(Wall Street Journal) -- WSJ.com repots, "The scientific community is buzzing over thousands of emails and documents ... that some say raise ethical questions about a group of scientists who contend humans are responsible for global warming." According to the story, the emails -- which were obtained by a group of hackers -- "include discussions of apparent efforts to make sure that reports from the Intergovernmental Panel on Climate Change, a United Nations group that monitors climate science, include their own views and exclude others. In addition, emails show that climate scientists declined to make their data available to scientists whose views they disagreed with." See the WSJ.com story at <http://online.wsj.com/article/SB125883405294859215.html>

SHOULD THE GOVERNMENT GET INVOLVED?

Do you know someone who thinks the government should be running health care and our banks? The next time you talk to them, read them the following list:

- Up to 12 different agencies are responsible for administering more than 35 food-safety laws.

- There are 541 clean air, water, and waste programs spread out over 29 agencies.

- 40 different programs aimed primarily at job training are administered by at least 7 different federal agencies.

- 50 different programs to aid the homeless are administered by at least 8 different federal agencies.

- 9 different agencies operate 27 teen-pregnancy programs and 11 agencies administer at least 90 early-childhood programs.

Thursday, December 3, 2009

'HEALTH CARE SURTAX WOULD HURT ECONOMY, HEALTH CARE'

(Budget & Tax News) -- The Heartland Institute reports that "the top tax rates in 39 states would climb above 50% under a plan to overhaul the nation’s health care system, according to an analysis by the nonpartisan Tax Foundation." "'This proposed tax increase will be levied at a time when Americans can least afford it and will affect countless small businesses that file individual returns,' including sole proprietorships, S Corporations, and partnerships, said economist Jonathan Williams, director of the Tax and Fiscal Policy Task Force of the American Legislative Exchange Council. ... 'This tax increase is a job killer, plain and simple,' Williams added." See more at <http://www.heartland.org/publications/budget%20tax/article/25914/Health_Care_Surtax_Would_Hurt_Economy_Health_Care.html

IRS ANNOUNCES 2010 STANDARD MILEAGE RATES

The Internal Revenue Service today issued the 2010 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

Beginning on Jan. 1, 2010, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

The standard mileage rate for business is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs as determined by the same study.

Revenue Procedure 2009-54 contains additional details regarding the standard mileage rates.

Beginning on Jan. 1, 2010, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

- 50 cents per mile for business miles driven

- 16.5 cents per mile driven for medical or moving purposes

- 14 cents per mile driven in service of charitable organizations

The standard mileage rate for business is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs as determined by the same study.

Revenue Procedure 2009-54 contains additional details regarding the standard mileage rates.

Wednesday, December 2, 2009

ONLY IN AMERICA (CANADA IS PART OF AMERICA YOU KNOW)

'Being ‘happy’ on Facebook leads to denial of claim for depression'

(Insurance & Financial Advisor Web News) -- IFAwebnews.com reports that "when a Canadian woman posted photos of herself on a beach vacation and partying at a Chippendale’s club, the insurance company that had been paying benefits for nearly 18 months because of her inability to work due to major depression found the postings to be anything but 'mundane.'" The insurance company "halted benefits payments to the Quebec woman after an investigation found photos of her in less-than-depressed situations. ... Nathalie Blanchard is fuming because she says that vacations and partying are part of her therapy." See the story at <http://ifawebnews.com/2009/11/23/being-happy-on-facebook-leads-to-denial-of-claim-for-depression/>

(Insurance & Financial Advisor Web News) -- IFAwebnews.com reports that "when a Canadian woman posted photos of herself on a beach vacation and partying at a Chippendale’s club, the insurance company that had been paying benefits for nearly 18 months because of her inability to work due to major depression found the postings to be anything but 'mundane.'" The insurance company "halted benefits payments to the Quebec woman after an investigation found photos of her in less-than-depressed situations. ... Nathalie Blanchard is fuming because she says that vacations and partying are part of her therapy." See the story at <http://ifawebnews.com/2009/11/23/being-happy-on-facebook-leads-to-denial-of-claim-for-depression/>

Tuesday, December 1, 2009

MORE ON THE HEALTH CARE BILL

'Governor: Health Care Bill Represents $624 Million in Unfunded Mandates for Neb.'

(Governor's release) -- On Friday, Gov. Dave Heineman sent a letter to Nebraska’s U.S. senators and congressmen regarding the health care reform proposal being considered in the U.S. Senate. The Governor's letter reports that one version of the Senate health care bill would create an estimated unfunded mandate of more than $127 million during the bill's first five years. If the state provided optional expanded coverage during FY 2011-13, costs to the state would total more than $497 million, for a combined total exceeding $624 million. See the release at <http://www.governor.nebraska.gov/news/2009/2009_11/20_health_care_bill.html>

(Governor's release) -- On Friday, Gov. Dave Heineman sent a letter to Nebraska’s U.S. senators and congressmen regarding the health care reform proposal being considered in the U.S. Senate. The Governor's letter reports that one version of the Senate health care bill would create an estimated unfunded mandate of more than $127 million during the bill's first five years. If the state provided optional expanded coverage during FY 2011-13, costs to the state would total more than $497 million, for a combined total exceeding $624 million. See the release at <http://www.governor.nebraska.gov/news/2009/2009_11/20_health_care_bill.html>

QUOTE OF THE WEEK

"The White House and the Senate

Democrats are working on a new

jobs bill. The White House said this

new jobs bill could create twice as

many non-existent fake jobs as

the last one."

Jay Leno

Democrats are working on a new

jobs bill. The White House said this

new jobs bill could create twice as

many non-existent fake jobs as

the last one."

Jay Leno

Subscribe to:

Comments (Atom)